Even as things start to tentatively open back up, the effect COVID-19 has had on people and businesses around the world seems to be heightened with each passing day.

From health fears to market disruption to the complete upending of our daily lives, this crisis has been about as real as it gets. US consumers have been sheltering in place since mid-March, causing a standstill in almost every industry and every aspect of business.

As the watchmaking community tries to wrap its head around what’s happening and what can be done, many recurring questions come to mind:

One question we at Overskies are thinking about a lot is this: Does this actually present a unique opportunity for watch companies to strengthen their brands moving forward?

Certain industries have been affected much more than others. It’s clear that retail brands have been presented with a unique set of challenges, making it crucial to have a well-thought-out recovery strategy in place.

This guide is geared specifically toward helping watch companies grasp what their customers are going through and understand their shifting behaviors. It will also provide resources to navigate the uncertainty and be ready to pivot as things get back to normal — whatever that may look like in the months to come.

A massive disruption has occurred in our world, and it’s forcing many watch brands to rethink their relationship with customers both now and in the long term. Customers have voluntarily or involuntarily pulled back from retail and luxury spending, leaving us all wondering when — and how — to reestablish consumer relevance.

To do this, it’s crucial we understand the current state of the consumer. When we begin to look closely at the effect COVID-19 is having on people, we see implications on how they are feeling, behaving, shopping, and more.

Let’s start by trying to sum up the overall mood. We’ve been hearing words like “anxious,” “frustrated,” “rattled,” and “moody” to describe the general current mentality.

However, according to the Harvard Business Review, what we’re actually experiencing is grief. There’s a collective sense of grief hanging in the air with a range of stages from denial to anger to sadness to acceptance.

This persistent sense of grief and the fact that most of us are sheltering in place has altered our behavior drastically. Nearly 90% of consumers have admitted to changes in their usual behavior because of COVID-19, and we would argue that figure is closer to 100%.

There are, of course, other societal factors that are contributing to these changes as well.

The ramifications of COVID-19, whether it be pulling us together or pushing us apart, are strengthening certain perspectives that, as marketers, we are keen to understand.

There’s no denying the financial fallout from this pandemic is severely impacting individual consumers, brands, and industries as a whole.

The watch industry is no exception to these effects, as many brands are being forced to take on a leaner approach to staffing by furloughing or letting go of employees, many of whom handle crucial marketing duties.

We've also seen major disruption across key industry events planned for this year and beyond, with Watches & Wonders, JCK, and Baselworld all being adversely affected. The latter, one of the largest watch and jewelry shows in the world, now finds the future of its franchise in jeopardy due to disputes with exhibitors over the canceled 2020 show. Now, it's been announced that Baselworld 2021 has been canceled.

This leaves us all wondering if this will be the end of the line for the world’s largest industry trade show, and if it will be replaced by a new watch show in the future.

Stay tuned — things are about to get interesting.

Even as things tentatively start opening back up, we’re seeing significant shifts in media consumption toward an online- and TV-dominated reality, especially for connectivity, shopping, and entertainment purposes. In fact, Nielsen predicts that video content viewing has jumped 60% in US homes in the past month.

Sources: Comscore April 2020 and Google Trends (past 30 days as of 4/16)

All of these concerns and changes are collectively driving a new norm when it comes to consumer expectations.

The New Reality

• Mood & Sentiment

• Changes in Behavior

• Shift in Perspectives

• Financial Concerns

• Media Consumption

Recovery Guidance for Watch Brands

• Immediate Response

• Long-Term Response

As we gain an understanding of how consumers have been feeling and changing, watch brands ought to be asking themselves: How can I rethink my strategy based on what I’ve learned?

We at CSI keep coming back to the question of how brands can contribute to and support customers at as many moments as possible. This comes with an understanding that now may not be the time to push watch sales, but rather to lend trusted support.

Marketers mustn't sit on the sidelines and wait for the dust to settle; now is the time to get cracking. If you want to remain relevant and profitable in the future, it starts with planting the seeds of understanding, trust, and meaningful action now.

Our most important piece of advice is this: Don’t be silent!

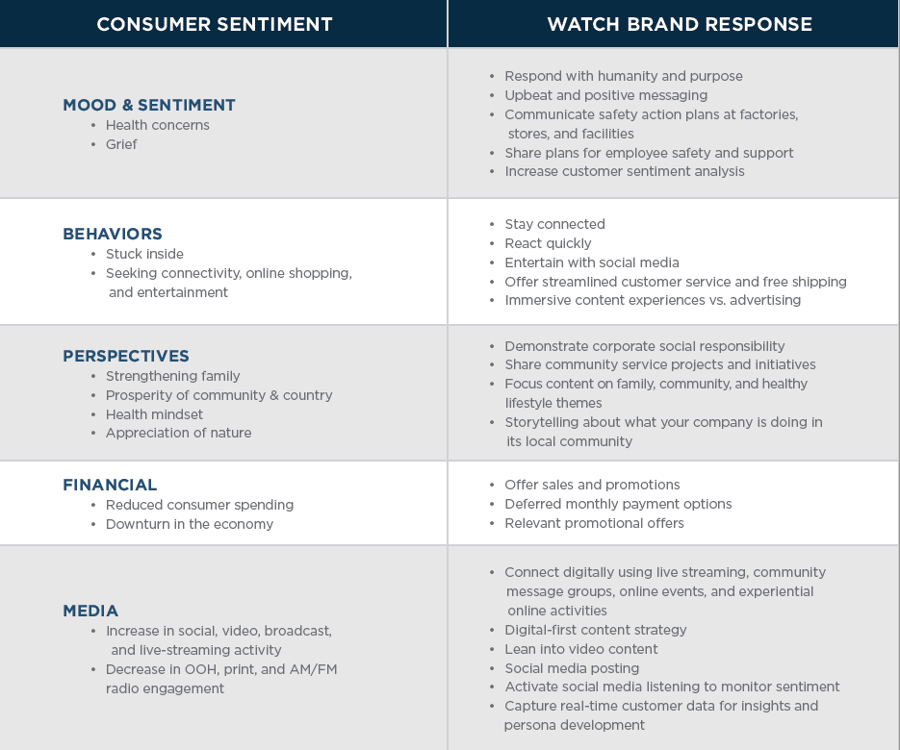

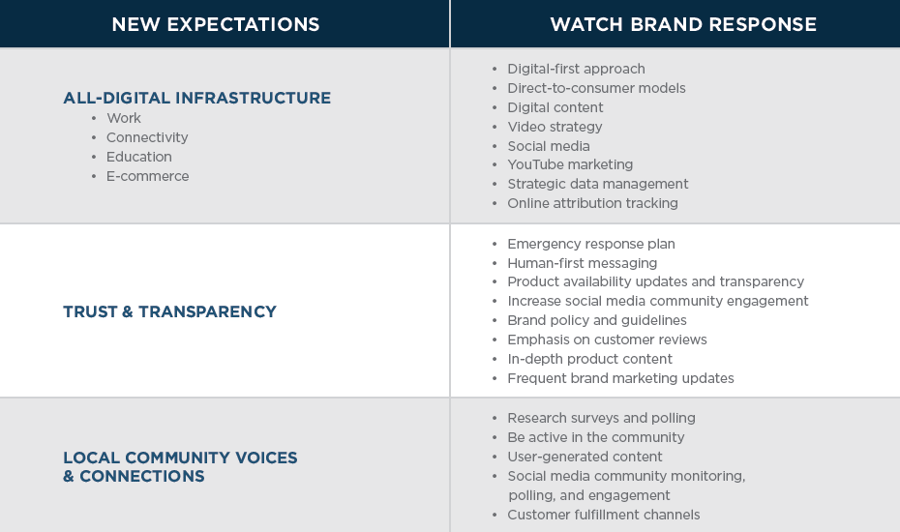

Below, we’ve taken the approach of organizing smart, short-term watch brand responses based on the consumer sentiments and changes we’ve already covered.

Looking to the future, watch brands are going to need to rethink some of their strategies as we move into the recovery phase. We can look at this crazy moment in time as a stress test to evaluate just how future-proof a brand really is.

Let’s continue the same exercise of looking at consumers’ new expectations that we think are going to stick, and explore how brands can respond in the future.

As states start to open back up, it’s crucial for watchmakers to have created some strong brand momentum. Consumers are ready for normalcy.

Don’t be caught empty-handed and have to play catch-up with your marketing initiatives to meet the new needs and expectations of your customers, sales team, stores, and retail partners. If you are not ready when consumers are able to shop again, someone else will be.

Here is a playbook with strategic suggestions to help watchmakers turn this moment in time into an opportunity to strengthen their brand based on what we’ve learned.

Begin by conducting research. Supporting and contributing to customers’ lives requires a sophisticated level of understanding.

Conducting primary research surveys and more in-depth attitudinal segmentation analyses can help watch brands tremendously from a marketing and content standpoint. Well-conducted research will provide insights such as when consumers will be ready to purchase again, brand content they look forward to, what they look for in a timepiece, motivations for purchase, creative that resonates, media preferences, and more.

Over the course of the next few months, it’s important to build trust by offering your customers useful information that doesn’t try to sell them a watch. From content to live events, this new approach can come in many forms.

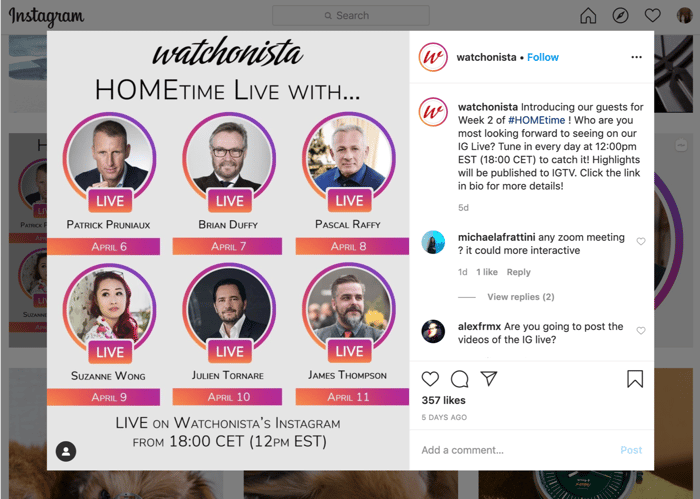

One that caught our eye was from our friends at Watchonista. In March, they began an Instagram Live series called “HOMEtime” that we recommend either trying to get in on or using something similar to your advantage. Every day, HOMEtime provides watch enthusiasts with engaging conversations from today’s most notable industry personalities and executives sharing brand updates, opinions, news, and more.

We’re not suggesting that you implode decades of legacy and roll out a new company mission statement, but it would be wise to re-evaluate what you stand for in the context of what we’ve all gone through and what’s become more important to us.

We won’t drone on and on about all the marketing cliches of what a watch represents, but if there was ever a time to roll out content ideas and promotions around how precious our time actually is and how we should be making the most of it, it’s now.

We like the idea of rolling out a special watch promotion with unique messaging anchored in reconnecting with loved ones during the next phase. A focused promotional offer shows both empathy and relevance to customers that have just been through a lot.

From a more long-term brand guidelines standpoint, think about adjusting imagery, assets, and tone in a way that will purposefully resonate with a society fully embracing re-connectivity. Everyone is hopeful that by this summer, friends, family, and communities will be coming together again both physically and emotionally. Get your creative team brainstorming on all the ways your watch messaging can tap into this by refreshing lifestyle shots, content themes, taglines, in-store signage, and social content, to name a few.

It’s clear that watch brands should begin to lean even further into digital channels to connect with customers and ultimately drive direct sales.

Here’s a range of suggestions to elevate your brand’s digital presence:

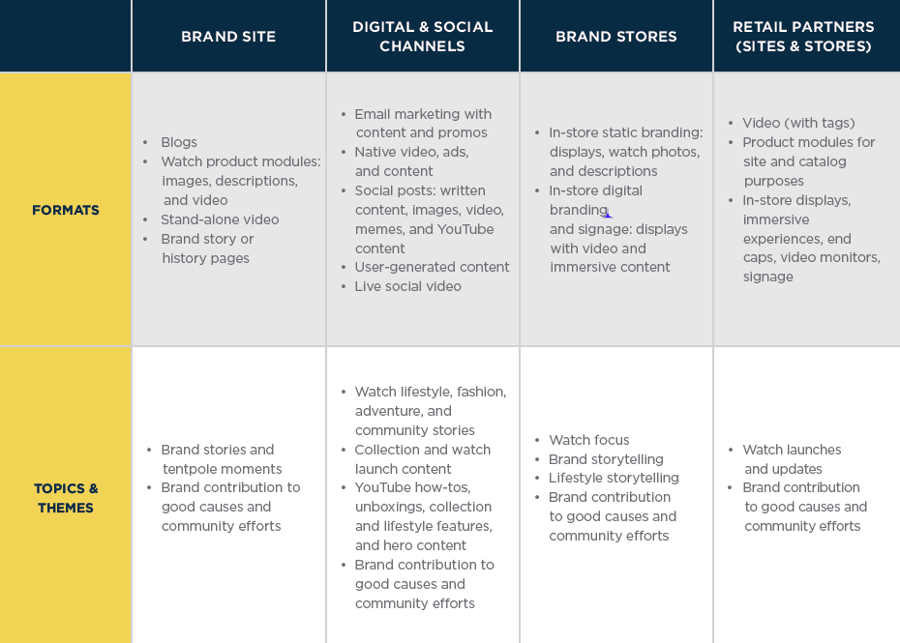

A great way to begin integrating your watch brand back into the lives of consumers is through great content instead of advertising. In doing so, brands must be able to feed their funnels with enough online and offline content to meet the demands of customers, retail partners, and sales teams.

Based on consumer sentiments and new expectations, we recommend:

Be sure to re-evaluate your watch launches and marketing calendars to account for real-world factors as we look to the remainder of 2020 and ahead toward 2021.

Many spring/summer watch launches have been wrecked, causing a chain reaction on all planned launches moving into the fall and the crucial holiday season. From re-prioritizing launches to managing co-op advertising dollars to driving sell-through of current inventory, this is a complex set of issues.

There are a few ways watch brands can look ahead toward re-engaging consumers when they’re ready to start buying again:

We recommend taking a content-first approach instead of advertising to drive demand at the retailer and consumer levels.

Content allows you to begin sowing the seeds earlier than usual by revealing juicy products details leading up to your launch through mini teaser campaigns. Begin pushing out a range of content experiences to build momentum by focusing on lifestyle and key differentiation features to get buyers excited.

By shifting just a small portion of your advertising budget toward producing some evergreen pieces of content that have legs, brands can efficiently and effectively fuel ongoing product and brand messaging across their owned media channels.

While we’re on the topic of saving money, now may also be the time to pivot toward a programmatic digital advertising approach instead of going direct-to-publisher, which always comes at a premium. The watch market isn’t the only one under strain — supply and demand on the programmatic exchanges are driving significantly discounted inventory.

From a timing standpoint, think about focusing on select moments where your messaging is most likely to resonate. As we see individuals prioritizing family and community, watch brands should capitalize on some of the upcoming re-connection moments.

Example of Bagel Bites’s #RadDadSquad UGC initiative launched around Father’s Day

In addition to the big moments, there’s also an increased appreciation for the small moments that we once took for granted like coffee dates with friends, a child’s Little League game, and family dinners.

Part of our collective grief during the current crisis is that time has become amorphous and the days blur together at home. People are looking forward to a time when they’ll have somewhere to be — important dates and appointments when they’ll need to wear a watch again.

As things begin to reopen, it also makes sense to use email and social media to update customers with operational and safety information such as store hours, store cleaning and safety policies, employee updates, and watch availability.

Now stronger and more diversified than ever, social media gives watch brands access to different groups of customers and a range of great content and ad formats at scale. One such platform we cannot recommend strongly enough is YouTube.

YouTube offers everything that modern consumers have come to rely on, serving as an all-in-one video, social, search, and now modern-day TV platform that accounts for 35% of global Internet traffic. Believe it or not, there was such a huge surge in viewership in the past few weeks that YouTube had to actually reduce the streaming quality of its videos, as the strain was too much on Internet providers. Talk about a ridiculously powerful platform!

A well-loved YouTube channel allows watchmakers to create an immersive video destination without being overly salesy using unboxing, how-to, and lifestyle video content. And it’s more than just education and inspiration, as the platform is now offering shoppable ad experiences as well.

It’s also worth thinking about tapping into the new breed of influencers emerging on social media. Some of the most relevant, authentic voices and sources of authority coming out of this situation wear scrubs, work in labs, or lead communities. Think about how your brand can support them and help highlight their causes.

Even though digital is reigning supreme at the moment, let’s not forget about the importance of evolving your in-store shopping experiences. When customers are finally able to return to your brick-and-mortar locations, consider offering signage that reassures them that your location has been deep-cleaned, offers autonomous checkouts, and digital in-store access, to name a few ideas.

Brands are obviously more in control of these experiences at their own flagship or outlet locations, but you can be proactive with your national accounts and ask how you can help. Pop-up stores are also a great way to bolster your brand in key markets, giving customers new product access and perks, as well as tapping into the heart of local communities.

To get watch sell-in going again across national accounts and local jewelry partners, start thinking about proactively empowering your sales team now so they are prepared to strike once shelter-in-place orders have been lifted. Start leaning into understanding what’s going to help field reps succeed moving forward.

We’re banking that priority No. 1 will be investing in customer relationships and channel partnerships to ensure a healthy and happy pipeline moving forward. To do this, sales teams need to be empowered to reward customers with loyalty programs, discounts, and incentives. It’s also a good idea to have your team ask their retail customers how your brand can help from a digital standpoint. Digital sales have probably served as a lifeline in the past few weeks, and they might be looking to bolster this medium with content and fresh ideas moving forward. This might include things like digital vs. printed catalogs, signage, and content assets.

Lastly, strengthening your relationship with existing customers will only set you up for success. When a customer buys your watch, it’s not the end of the journey, but rather the beginning of the repurchase and renewal phase.

Efforts need to be made to deepen the connection with these customers through blogging, social media content, email marketing, experiential and direct marketing, and engaging directly via friendly, responsive customer service.

One of the most effective forms of fostering this brand-to-customer relationship is encouraging and subsequently sharing user-generated content (UGC). Remember, the watch industry is predicated on the self-expression of style. Most customers don’t buy your watches on a whim — they buy them because they think they look great and communicate something about their own status and personality. So, since each of your customers is armed with a video-enabled smartphone and an average of 7 social media accounts, why not allow them to share their own content featuring your watches?

To say it’s a unique time in our world right now is an understatement. We’re all collectively grappling with what this global pandemic will mean for us moving forward — as humans, as professionals, and as the brands we represent.

There might be more questions than answers, but we believe there are things watch brands should be doing in this moment that will make them memorable, meaningful, and successful for years to come. We hope the information shared here will prove useful in paving the way for your brand. Best of luck!

“The best way to predict the future is to invent it.” - Alan Kay

CSI is an independent, full-service creative agency that doesn’t believe in B2B or B2C. We believe in H2H: human-to-human. We're obsessed with understanding what makes people tick, what informs their buying decisions, and how to reach them in ways that drive real human connection and revenue for your brand.